Last week I wrote about the coming Democratic cave on the Bush tax cuts, and, among other things, I criticized Jim Himes for coming out in support of maintaining said tax cuts. I actually got a comment, the relevant portion of which reads as follows:

Himes is in a difficult position when you look at his generally wealthy constituency in Fairfield County. Himes has always voted with his constituency and has worked to bring us out of the financial runt Bush left us in… he has supported holding Wall St accountable, making health care affordable and voting for Energy Reform.

This argument has a superficial appeal, but lets examine it a bit. No constituency is monolithic and in virtually every case a representative must choose the portion of his or her constituency with which he will stand. Who has Himes chosen?

First, lets back up and recall that the tax cut in question was designed to disproportionately favor the rich, with a sliver of a tax cut for the rest of us solely to enable the Republicans to implausibly claim that they were delivering a tax cut for everyone. The tax cut was financed by borrowed money; money borrowed from, among other sources, the social security trust fund that we are now told is in such bad condition that we must trim benefits. The tax cut was bad policy when it was passed. It has not, like a good wine, improved with age.

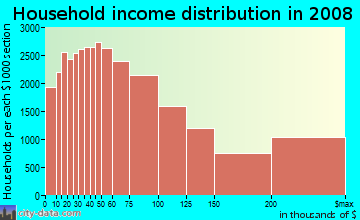

Now, lets take a look at Himes constituency. And bear in mind that Obama’s plan affects only that portion of a taxpayer’s income that is over $250,000.00 a year. Himes represents a diverse constituency. One might say they are more affluent, on average, than the average American, but it’s hard to make the case that they are generally wealthy, if we use the $250,000.00 figure as a benchmark of wealth. The mean income in Himes district is about $80,000.00. That’s better than the national average, but it still means that the 50% of the people in his district below that median figure have no interest in seeing these tax cuts continued. I wasn’t able to find better figures on the distribution by percentiles, but I was able to find this graph, poorly organized as it is:

This is inexact, but I gather from this graph that between 3 and 5 percent of the population of Himes district makes between $200,000 and infinity a year, and I would venture to say that most of those folks are clustered at or below the $250,000.00 point. Maybe not, as this source, which I’ll quote later, says 5% of the Fairfield County population earns more than $850,000.00 a year. So lets put the affected households at 10%, which I’m sure is generous. I would stake my fortune, by the way (not that I have one) that most of those folks vote Republican. In any event, these are the constituents that Himes has chosen to represent, not the remaining 90%+, who will bear the burden of paying the principal and interest on the debt he has chosen to accumulate to continue this giveaway, a form of deficit spending that has no stimulative effect.

This is inexact, but I gather from this graph that between 3 and 5 percent of the population of Himes district makes between $200,000 and infinity a year, and I would venture to say that most of those folks are clustered at or below the $250,000.00 point. Maybe not, as this source, which I’ll quote later, says 5% of the Fairfield County population earns more than $850,000.00 a year. So lets put the affected households at 10%, which I’m sure is generous. I would stake my fortune, by the way (not that I have one) that most of those folks vote Republican. In any event, these are the constituents that Himes has chosen to represent, not the remaining 90%+, who will bear the burden of paying the principal and interest on the debt he has chosen to accumulate to continue this giveaway, a form of deficit spending that has no stimulative effect.

This tax policy does more than just prefer the rich, it undermines our democracy by increasing the inequality in this country. A nation with a high degree of economic inequality simply cannot maintain a representative democratic structure. The present tax policy, particularly if one adds the abolition of the estate tax, is designed with the purpose and intent of creating a permanent aristocracy of inherited wealth in this country. One of the main reasons for instituting the estate and income taxes was to control that phenomenon; to make sure that even the descendant of a Rockefeller would have to work for a living, to make good, in other words, on Jefferson’s observation that “the mass of mankind has not been born with saddles on their backs, nor a favored few booted and spurred, ready to ride them legitimately, by the grace of God”.

This is not a new problem. Back in 1997, before the Bush giveaway, Connecticut’s comptroller noted that median income in Connecticut was stagnant but:

Despite the poor showing of median income and hourly wages, per capita income in Connecticut increased 5.7 percent between 1994 and 1995, the strongest gain since 1992. The contradictory movement in these income indicators points to increasing income stratification in Connecticut: those at the top are realizing strong income gains, and those at the bottom are losing ground. This income distribution pattern is consistent with a national trend of growing income inequality. It should be noted that Connecticut’s per capita income is the highest in the nation — 33 percent above the national average for 1995.

If I might mangle George Orwell: all places are unequal but some are more unequal than others. Fairfield County is the most unequal of all:

According to the U.S. Bureau of the Census, the Bridgeport-Stamford-Norwalk metro area has the most income inequality of any area in the United States. In this region, the bottom 20 percent of the population earns an average of $17,000. That’s a bit better off than most of the country. Across the United States, the bottom 20 percent of the population earns an average of $12,000. But in Southern Connecticut, the top 5 percent in the area are earning an incredible $823,000 a year, or 49 times as much as their poor neighbors.

It is those poor and middle class people, who must bear the burden of the debt we are accumulating to let those 5% keep their undeserved tax cut. Why isn’t Himes representing them? There are more of them after all, and a greater proportion of them are Democrats-the very people who put him in office.

But, as Paul Krugman points out, these rich people are angry, because the rest of us can’t understand how hard it is to get by on a mere half million or more a year. And they know how to get their way:

You see, the rich are different from you and me: they have more influence. It’s partly a matter of campaign contributions, but it’s also a matter of social pressure, since politicians spend a lot of time hanging out with the wealthy. So when the rich face the prospect of paying an extra 3 or 4 percent of their income in taxes, politicians feel their pain — feel it much more acutely, it’s clear, than they feel the pain of families who are losing their jobs, their houses, and their hopes.

And when the tax fight is over, one way or another, you can be sure that the people currently defending the incomes of the elite will go back to demanding cuts in Social Security and aid to the unemployed. America must make hard choices, they’ll say; we all have to be willing to make sacrifices.

But when they say “we,” they mean “you.” Sacrifice is for the little people.

Those are the people that Himes is representing.

But with due respect to Paul, I think John Fogarty made Krugman’s point better, or at least more poetically, more than 30 years ago:

Some folks are born silver spoon in hand,

Lord, don’t they help themselves, oh.

But when the taxman comes to the door,

Lord, the house looks like a rummage sale, yes,..

Some folks inherit star spangled eyes,

Ooh, they send you down to war, Lord,

And when you ask them, “How much should we give?”

Ooh, they only answer More! more! more!

One Comment